Momentum Based Etf Rotation - Amazing Backtested Results - Need Reviews

Introduction

In response to a question from a member of my subscription service, I did some enquiry and got some results that I want to share more broadly by writing this article. The reader asked me if I followed up on an article I published on 9 December 2014. He wanted to find out how that model performed out-of-sample. Short answer: It did not perform well in 2015 and 2016, but it recovered well, and made skillful gains over all the post-obit years.

For those who have read my early SA articles, my beginning momentum strategy was to utilize three-month momentum ranking to six ETFs: QQQ, SPY, MDY, IWM, EEM, TLT. Re-allocations were done monthly, at market place close, and all the funds were invested in the asset with the highest total return over the previous 3 months. Here is a link to that article.

The commodity was published in December 2014, and for the next two years, 2015 and 2016, it performed poorly. Only, starting in 2017, it fabricated good profits, beating the market.

Much better results could exist realized by applying our recently published strategies. One of the simplest strategies that we shall demonstrate hither consists of the following changes: employ a dual-momentum strategy with DBB versus BIL for a single absolute momentum bespeak. Use TYD equally the prophylactic Treasury bond ETF instead of TLT

Monthly asset rotation strategy

Here is a quote from the article published in December 2014: "On the last trading day of each month, the assets are ranked by the previous iii-calendar month render. All funds are invested in the asset with the highest render, every bit long as that return is positive. If all the avails had negative returns over the previous 3 months, and then all funds are moved into greenbacks."

The half-dozen ETFs considered for investment are the following:

- iShares 20+ Year Treasury (TLT),

- PowerShares QQQ Trust, Serial 1 (QQQ),

- SPDR S&P 500 (SPY),

- SPDR South&P 400 (MDY),

- iShares Russell 2000 (IWM), and

- iShares MSCI Emerging Markets (EEM).

For the period January 2004 - Dec 2014 the momentum rotation strategy performed uncommonly well. See the table:

Portfolio 2004-2014 Initial Balance Final Balance CAGR Stdev Max DD Sharpe ratio Momentum $x,000 $104,046 23.73% 17.96% -15.46% 1.20 SPY $10,000 $22,935 seven.94% 14.14% -50.97% 0.51

Performance two-years postal service publication (one/2015 - 12/2016)

During 2015 and 2016 the momentum rotation strategy performed poorly, essentially worse than the Southward&P 500.

Portfolio 2015-2016 Initial Remainder Final Rest CAGR Stdev Max DD Sharpe ratio Momentum $x,000 $seven,622 -12.seventy% 11.06% -25.92% -1.eighteen SPY $10,000 $11,321 vi.40% 11.91% -8.38% 0.56

Note: During 2015 and 2016 a simple equal weighting of all half-dozen assets of the portfolio performed much ameliorate than the momentum rotation strategy. That demonstrates that there are long time periods when using momentum is detrimental to your investments.

Performance since January 2017 (ane/2017 - vii/2021)

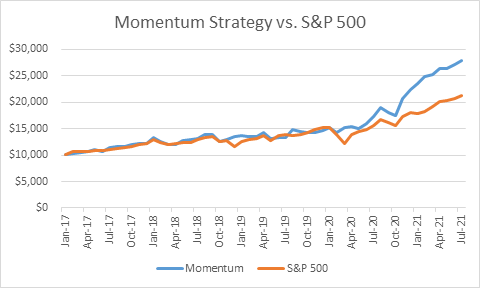

During 2017, 2018 and 2019 the momentum strategy performed in line with the S&P 500, but in 2020 and 2021 information technology vastly outperformed. See the table and chart below.

Portfolio 2017-2021 Initial Balance Final Residual CAGR Stdev Max DD Sharpe ratio Momentum $10,000 $27,839 25.03% xvi.87% -9.73% 1.34 SPY $10,000 $21,269 17.xc% 15.49% -19.63% 1.07

Functioning since January 2015 (1/2015 - 7/2021)

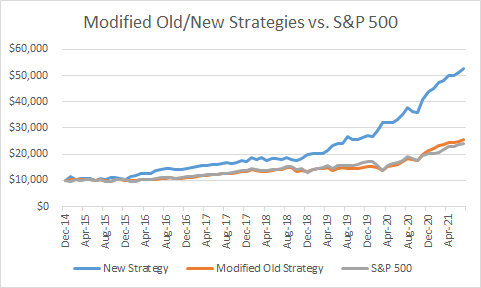

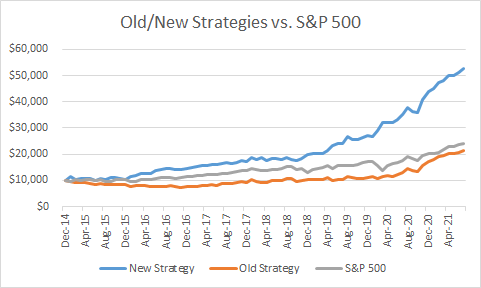

Nosotros compare the performance of three strategies for the whole time menses after the publication of the original strategy.

- The published strategy, chosen "Old Strategy" is investing in the asset with the highest three-month total return.

- A strategy chosen "Modified Old Strategy" is investing in the top 3 assets ranked past three-month total return.

- A dual momentum strategy, called "New Strategy" invests in the pinnacle three assets ranked by three-month full return during market hazard-on periods. Information technology invests in TYD, a 3X leveraged 7-10-twelvemonth Treasury bonds ETF during marketplace risk-off periods. The market is gamble-off when the three-calendar month full return of DBB, Invesco DB Metal Fund ETF is lower than the three-month risk-free total render.

The results are shown in the tabular array and chart below.

Portfolio 2015-2021 Initial Rest Terminal Balance CAGR Stdev Max DD Sharpe ratio Former Strategy $10,000 $21,219 12.11% 16.04% -25.92% 0.74 Modified Old Strategy $10,000 $25,754 15.threescore% 12.sixty% -ix.94% 1.xvi New Strategy $10,000 $52,678 28.71% 14.66% -11.27% 1.75 SPY $10,000 $24,079 fourteen.28% fourteen.50% -nineteen.63% 0.94

Conclusions

The momentum strategies may have long periods of under-operation. We have found that a unproblematic mitigation solution is to avoid investing all the funds in a single top momentum asset, just to spread the funds in a few elevation momentum avails. For the fix of ETFs we used in this article, nosotros found that iii or iv assets worked well.

The new strategies we developed in the concluding couple of years based on absolute momentum rules for market take chances-off periods, are performing substantially better. Additional performance improvements are obtained by investing in leveraged Treasury bonds during risk-off periods.

ADAPTIVE MOMENTUM INVESTING

Apply the results of our research to achieve superior returns while keeping losses manageable during astringent marketplace corrections.

Get access to our 4 portfolios:

- High yield bail ETFs

- Non-leveraged wide market ETFs

- High 3X Leverage ETFs

- Acme Momentum Large-cap stocks

Sign up for a Gratuitous TRIAL today

Source: https://seekingalpha.com/article/4447697-momentum-strategys-post-publication-performance

0 Response to "Momentum Based Etf Rotation - Amazing Backtested Results - Need Reviews"

Post a Comment